|

|

|

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a party other than the Registrant ☐

Check the appropriate box:

| | |

| | |

☐ | | Preliminary Proxy Statement |

☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | | Definitive Proxy Statement |

☐ | | Definitive Additional Materials |

☐ | | Soliciting Material Under §240.14a-12 |

Kadmon Holdings, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| | | | |

| |

☒

| | No fee required. |

| |

☐

| | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

☐

| | Fee paid previously with preliminary materials. |

| |

☐

| | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount previously paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing party: |

| | (4) | | Date Filed: |

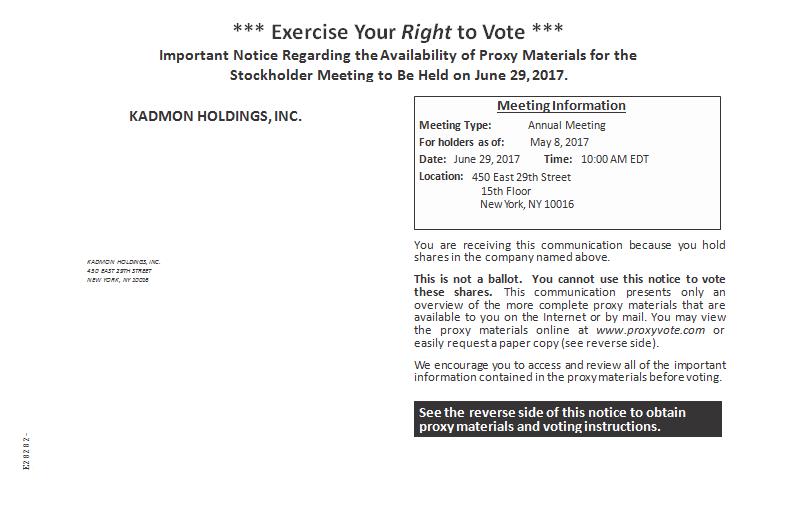

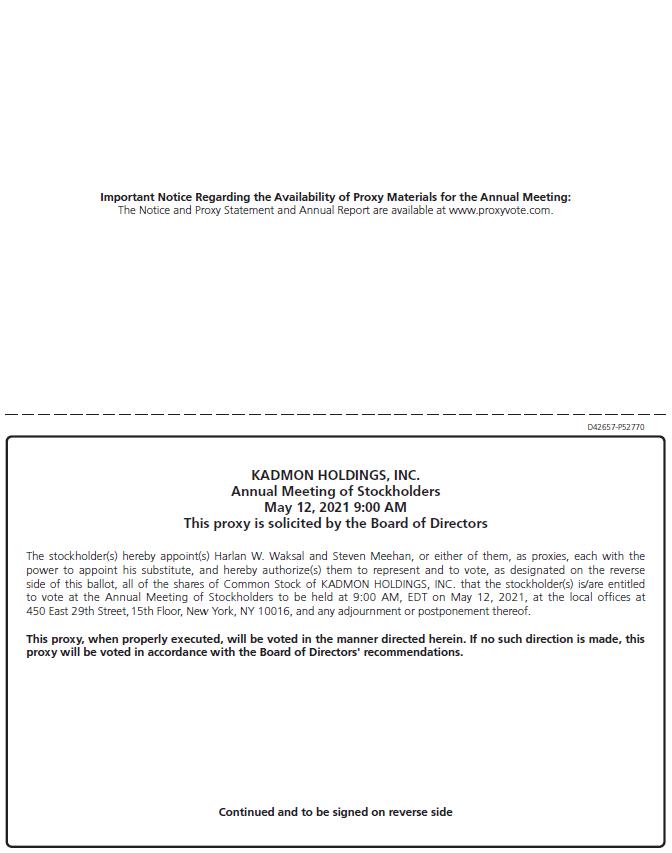

KADMON HOLDINGS, INC.

450 East 29th Street

New York, NY 10016

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 29, 2017MAY 12, 2021

To the Stockholders of Kadmon Holdings, Inc.:

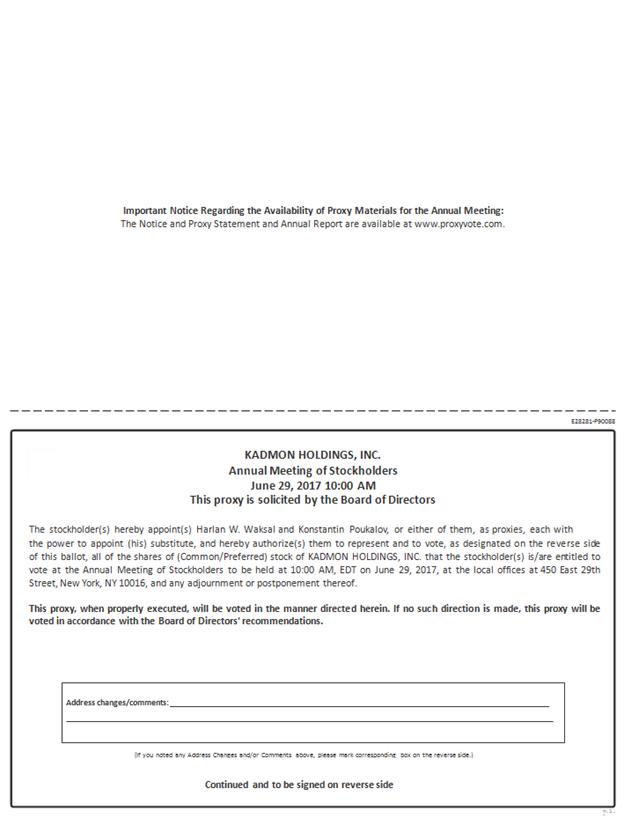

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders (the “Annual Meeting”) of Kadmon Holdings, Inc., a Delaware corporation (the “Company”), will be held on June 29, 2017,May 12, 2021 at 10:9:00 a.m. local time, at its offices located at 450 East 29th Street, New York, NY 10016 for the following purposes:

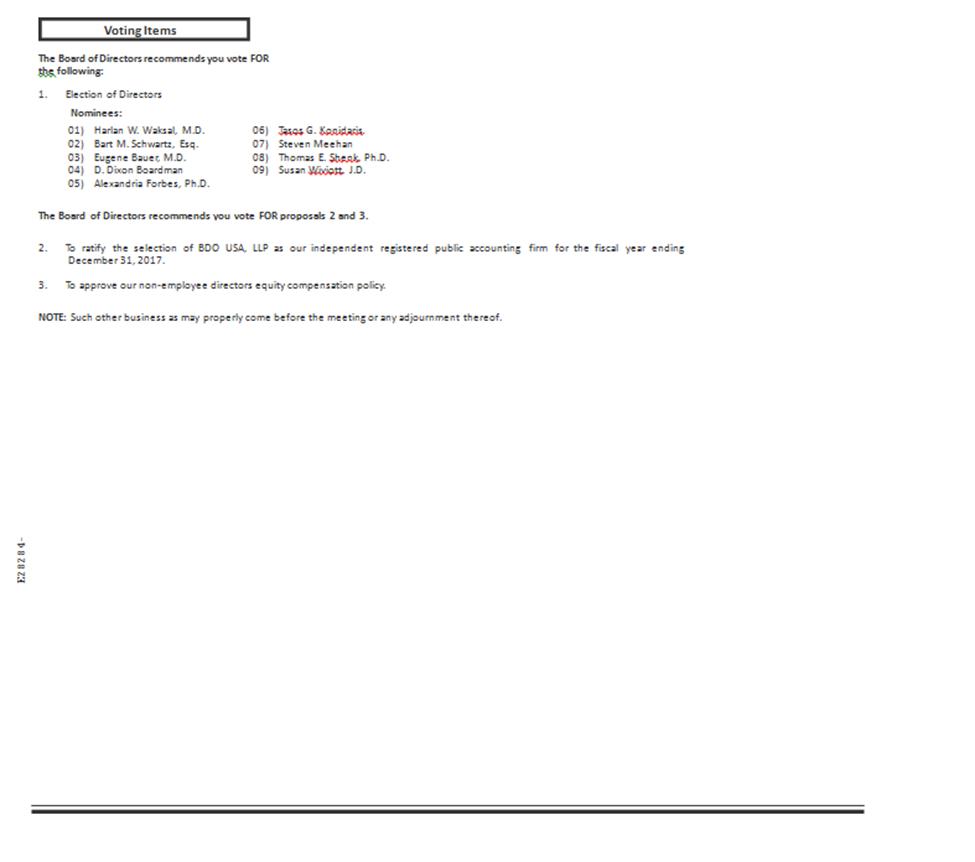

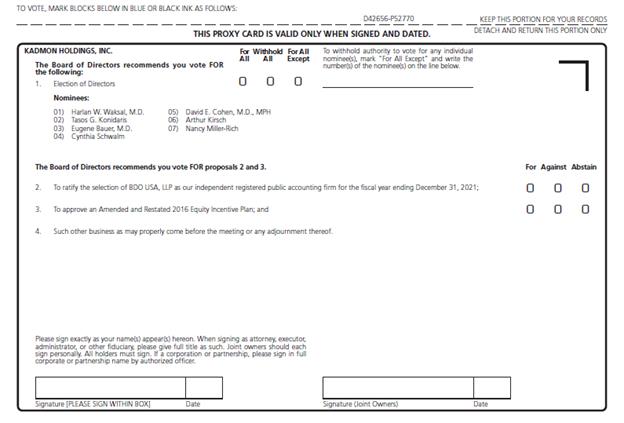

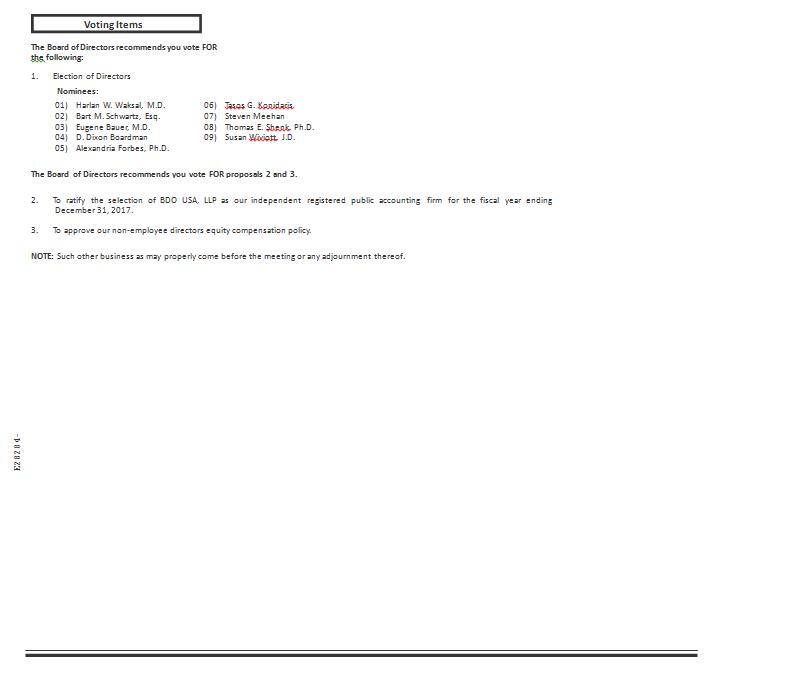

| 1. | | to elect nineseven directors to hold office until their successors are elected; |

| 2. | | to ratify the selection of BDO USA, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2017;2021; |

| 3. | | to approve our non-employee directors’ equity compensation policy;an Amended and Restated 2016 Equity Incentive Plan; and |

| 4. | | to transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

We are closely monitoring developments related to COVID-19. It could become necessary to change the date, time, location and/or means of holding the Annual Meeting (including by means of remote communication). If such a change is made, we will announce the change in advance, and details on how to participate will be issued by press release, posted on our website and filed as additional proxy materials.

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice of Annual Meeting of Stockholders. Only stockholders who owned common stock of the Company at the close of business on May 8, 2017March 15, 2021 (the “Record Date”) can vote at this meeting or any adjournments that take place.

The Board of Directors recommends that you vote FOR the election of the director nominees named in Proposal No. 1 of the Proxy Statement, FOR the ratification of the appointment of BDO USA, LLP, as the independent registered public accounting firm, as described in Proposal No. 2 of the Proxy Statement andFOR the approval of our non-employee directors’ equity compensation policy in Proposal No. 3 of the Proxy Statement.3.

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING IN PERSON, WE ENCOURAGE YOU TO READ THE ACCOMPANYING PROXY STATEMENT AND OUR ANNUAL REPORT ON FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2016,2020, AND SUBMIT YOUR PROXY AS SOON AS POSSIBLE USING ONE OF THE THREE CONVENIENT VOTING METHODS DESCRIBED IN “INFORMATION ABOUT THE PROXY PROCESS AND VOTING” IN THE PROXY STATEMENT. IF YOU RECEIVE MORE THAN ONE SET OF PROXY MATERIALS OR NOTICE OF INTERNET AVAILABILITY BECAUSE YOUR SHARES ARE REGISTERED IN DIFFERENT NAMES OR ADDRESSES, EACH PROXY SHOULD BE SIGNED AND SUBMITTED TO ENSURE THAT ALL OF YOUR SHARES WILL BE VOTED.

aa |

|

By Order of the Board of Directors |

|

/s/ Harlan W. Waksal |

Harlan W. Waksal, M.D. |

President and Chief Executive Officer |

New York, New York

May 10, 2017April 1, 2021

TABLE OF CONTENTS

KADMON HOLDINGS, INC.

450 East 29th Street

New York, New York 10016

PROXY STATEMENT

FOR THE 20172021 ANNUAL MEETING OF STOCKHOLDERS

JUNE 29, 2017May 12, 2021

We have sent you this Proxy Statement and the enclosed Proxy Card because the Board of Directors (the “Board”) of Kadmon Holdings, Inc. (referred to herein as the “Company,“Company” and “Kadmon,” “Kadmon,”and by the pronouns “we,” “us” or “our”) is soliciting your proxy to vote at our 20172021 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on Thursday, June 29, 2017,Wednesday, May 12, 2021, at 10:9:00 a.m. local time, at 450 East 29th Street, New York, New York 10016.

| · | | This Proxy Statement summarizes information about the proposals to be considered at the Annual Meeting and other information you may find useful in determining how to vote. |

| · | | The Proxy Card is the means by which you actually authorize another person to vote your shares in accordance with your instructions. |

In addition to solicitations by mail, our directors, officers and employees, without additional remuneration, may solicit proxies by telephone, e-mail and personal interviews. We may retain outside consultants to solicit proxies on our behalf as well. All costs of solicitation of proxies will be borne by us. Brokers, custodians and fiduciaries will be requested to forward proxy soliciting material to the owners of stock held in their names, and we will reimburse them for their reasonable out-of-pocket expenses incurred in connection with the distribution of proxy materials.

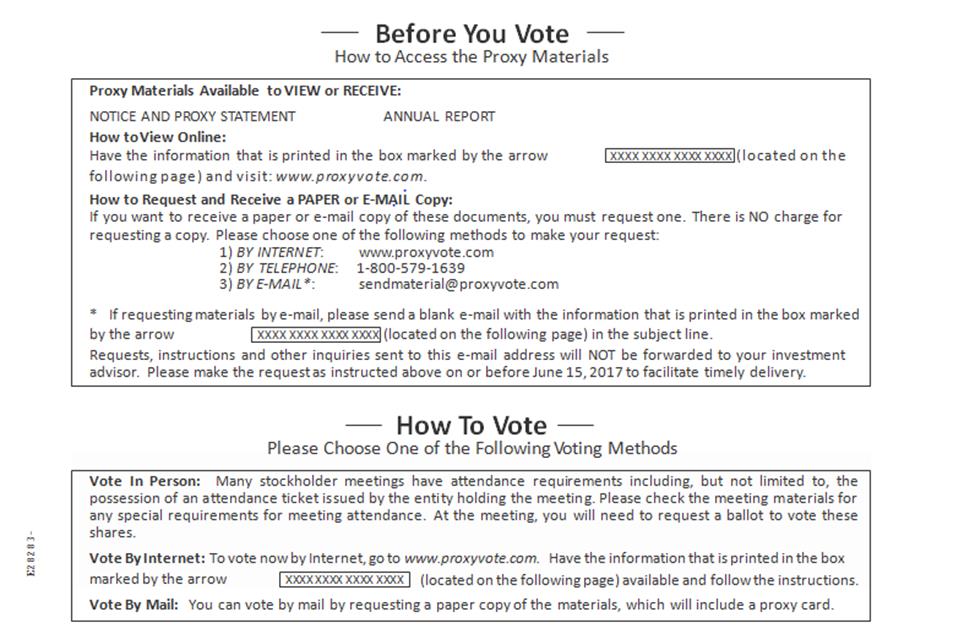

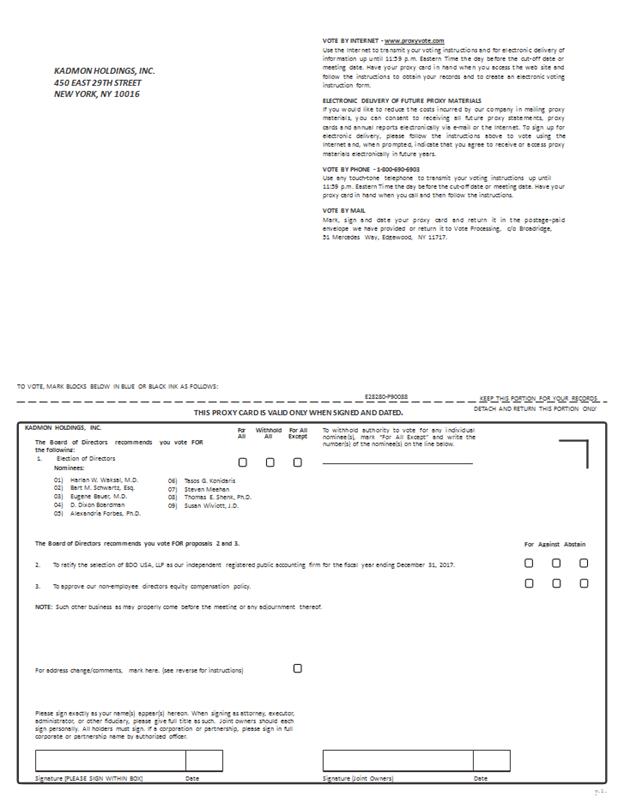

Pursuant to the rules adopted by the Securities and Exchange Commission (the “SEC”), we have elected to provide access to our Annual Meeting materials, which include this Proxy Statement and our Annual Report on Form 10-K for the year ended December 31, 20162020 (the “Form 10-K”), over the internet in lieu of mailing printed copies. We will begin mailing the Notice of Internet Availability to our stockholders of record as of May 8, 2017March 15, 2021 (the “Record Date”), for the first time on or about May 10, 2017.April 1, 2021. The Notice of Internet Availability will contain instructions on how to access and review the Annual Meeting materials and will also contain instructions on how to request a printed copy of the Annual Meeting materials. In addition, we have provided brokers, dealers, banks, voting trustees and their nominees, at our expense, with additional copies of our proxy materials and the Form 10-K so that our record holders can supply these materials to the beneficial owners of shares of our common stock as of the Record Date. The Form 10-K is also available in the “Financials & Filings” section of our website at http:https://investors.kadmon.com/financials-and-filings.financials-filings.

The only outstanding voting securities of Kadmon are shares of common stock, $0.001 par value per share (the “common stock”), of which there were 51,846,521171,816,945 shares outstanding as of the Record Date and shares of 5% convertible preferred stock, $0.001 par value per share (the “5% convertible preferred stock”), which votes on an as-converted basis with the holders of common stock, and of which there were 28,708 shares outstanding (which, on an as-converted basis, represents voting rights equivalent to approximately 3,750,664 shares of common stock) as of the Record Date. The holders of a majority in voting power of the shares of common stock and 5% convertible preferred stock issued and outstanding and entitled to vote, present in person or represented by proxy, are required to hold the Annual Meeting.

INFORMATION ABOUT THE PROXY PROCESS AND VOTING

Why am I receiving these materials?

We have made this Proxy Statement and Proxy Card available to you on the internet or, upon your request, have delivered printed proxy materials to you, because the Board is soliciting your proxy to vote at the Annual Meeting, including at any adjournments or postponements of the Annual Meeting. You are invited to attend the Annual Meeting to vote on the proposals described in this Proxy Statement. However, you do not need to attend the Annual Meeting to vote your shares. Instead, you may simply complete, sign and return the Proxy Card, or follow the instructions below to submit your proxy over the telephone or on the internet.

This Proxy Statement, the Notice of Internet Availability, the Notice of Annual Meeting and the accompanying Proxy Card were first made available for access by our stockholders on or about May 10, 2017April 1, 2021 to all stockholders of record entitled to vote at the Annual Meeting.

How do I attend the Annual Meeting?

Our Annual Meeting will be held at 450 East 29th Street, New York, New York 10016 on May 12, 2021. Directions to the Annual Meeting may be found at www.kadmon.com. Information on how to vote in person at the Annual Meeting is discussed below.

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on the Record Date will be entitled to vote at the Annual Meeting. At the close of business on the Record Date, there were 51,846,521171,816,945 shares of common stock issued, and outstanding, and entitled to vote.vote and 28,708 shares of 5% convertible preferred stock issued, outstanding, and entitled to vote (which, on an as-converted basis, represents voting rights equivalent to approximately 3,750,664 shares of common stock).

Stockholder of Record: Shares Registered in Your Name

If, on the Record Date, your shares were registered directly in your name with the transfer agent for our common stock and 5% convertible preferred stock, American Stock Transfer & Trust Company, LLC, then you are a stockholder of record. As a stockholder of record, you may vote in person at the Annual Meeting or vote by proxy. Whether or not you plan to attend the Annual Meeting, we encourage you to fill out and return the Proxy Card or vote by proxy over the telephone or on the internet as instructed below to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker, Bank or Other Agent

If, on the Record Date, your shares were held in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the Annual Meeting unless you request and obtain a valid Proxy Card from your broker or other agent.

How do I vote my shares if I am a stockholder of record?

If you are a stockholder of record (meaning that you hold shares in your name in the records of the transfer agent of our common stock and 5% convertible preferred stock, American Stock Transfer & Trust Company, LLC., and that your shares are not held in "street name" by a bank or brokerage firm), you may vote your shares in any one of the following ways:

| · | | You may vote by mail. If you requested and received a paper copy of a Proxy Card by mail pursuant to the instructions found on the Notice of Internet Availability, you may vote by mail. To vote by mail, you need to complete, date and sign the Proxy Card that accompanies this proxy statement and promptly mail it in the enclosed postage-prepaid envelope. You do not need to put a stamp on the enclosed envelope if you mail it from within the United States. If you return your signed Proxy Card to us before the Annual Meeting, we will vote your shares in accordance with the Proxy Card. |

| · | | You may vote over the internet. To vote over the internet, follow the instructions provided on the Notice of Internet Availability. If you vote over the internet, you do not need to complete and mail your Proxy Card. |

| · | | You may vote in person. If you attend the 2021 Annual Meeting, you may vote by delivering your completed Proxy Card in person or you may vote by completing a ballot at the 2021 Annual Meeting. Ballots will be available at the 2021 Annual Meeting.For your safety during the COVID-19 crisis, we recommend you vote by mail or over the internet. |

Your proxy will only be valid if you complete and return the Proxy Card or vote over the internet at or before the 2021 Annual Meeting. The persons named in the Proxy Card will vote the shares you own in accordance with your instructions on your Proxy Card or in your vote over the internet. If you return the Proxy Card or vote over the internet, but do not give any instructions on a particular matter described in this proxy statement, the persons named in the Proxy Card will vote the shares you own in accordance with the recommendations of our Board.

We provide internet proxy voting to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your internet access, such as usage charges from internet access providers.

How do I vote my shares if I hold them in "street name?"

If the shares you own are held in "street name" by a bank or brokerage firm, your bank or brokerage firm, as the record holder of your shares, is required to vote your shares according to your instructions. If you are a beneficial owner of shares registered in the name of your bank or brokerage firm, you should have received a voting instruction card and voting instructions with these proxy materials from that organization rather than from us. In order to vote your shares, you will need to follow the directions that your bank or brokerage firm provides to you. Many banks and brokerage firms solicit voting instructions over the internet or by telephone.

Under applicable stock exchange rules, banks or brokerage firms subject to these rules that hold shares in street name for customers have the discretion to vote those shares with respect to certain matters if they have not received instructions from the beneficial owners. Banks or brokerage firms will have this discretionary authority with respect to routine or "discretionary" matters. Among the proposals to be presented at the 2021 Annual Meeting, Proposal No. 2 (the ratification of the selection of our independent registered public accounting firm) is a discretionary matter, and banks and brokerage firms are permitted to vote your shares even if you have not given voting instructions. Proposal No. 1 (the election of directors) and Proposal No. 3 (approval of the Amended and Restated 2016 Equity Incentive Plan (the “2016 Equity Plan”) are non-routine or "non-discretionary" matters, and banks and brokerage firms cannot vote your shares on such proposals if you have not given voting instructions. Accordingly, if you own shares through a nominee, such as a broker or bank, please be sure to instruct your nominee how to vote to ensure that your vote is counted on all of the proposals. "Broker non-votes" occur when a bank or brokerage firm submits a proxy for shares but does not indicate a vote for a particular proposal because the bank or brokerage firm either does not have authority to vote on that proposal and has not received voting instructions from the beneficial owner, or has discretionary authority but chooses not to exercise it. The effect of broker non-votes is discussed below in the answer to the question "What vote is required to approve each matter and how will votes be counted?”

Even if your shares are held in street name, you are welcome to attend the 2021 Annual Meeting. If your shares are held in street name, you may not vote your shares in person at the 2021 Annual Meeting unless you obtain a proxy, executed in your favor, from the holder of record (i.e., your bank or brokerage firm). If you hold your shares in street name and wish to vote in person, please contact your bank or brokerage firm before the 2021 Annual Meeting to obtain the necessary proxy from the holder of record.

What am I being asked to vote on?

You are being asked to vote on three proposals:

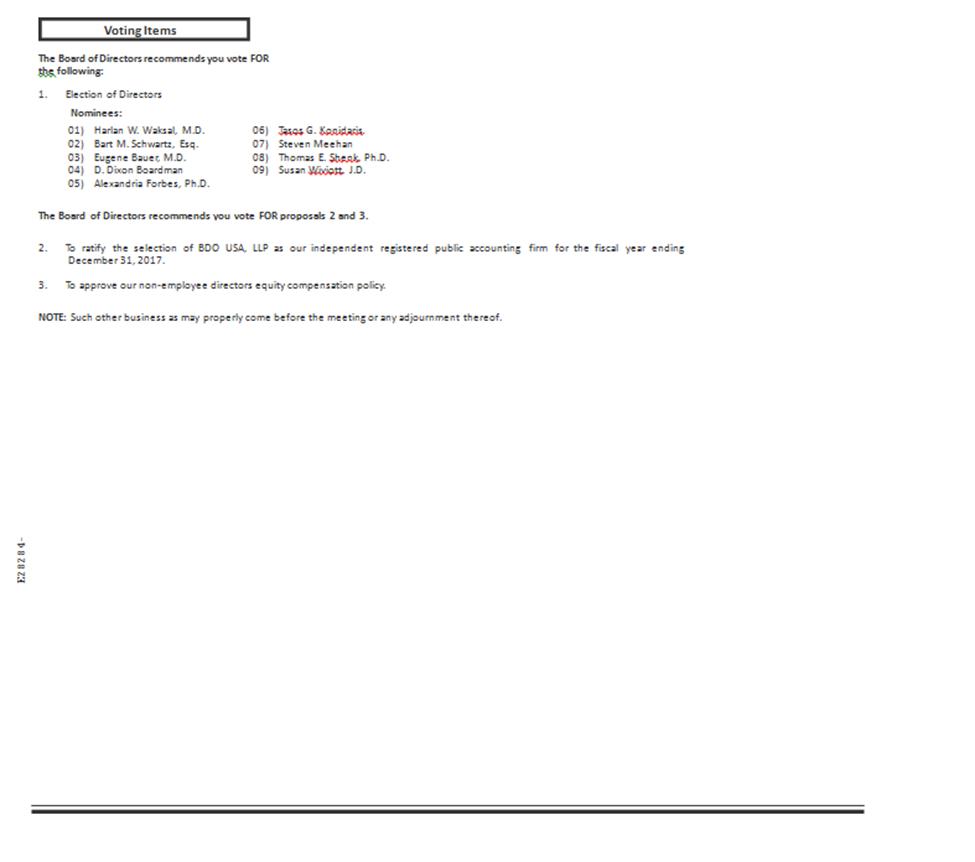

| · | | Proposal No. 1—the election of nineseven directors to hold office until their successors are elected; |

| · | | Proposal No. 2—the ratification of the selection, by the Audit Committee of our Board, of BDO USA, LLP, as our independent registered public accounting firm for the year ending December 31, 2017;2021; and |

| · | | Proposal No. 3—the vote to approve our non-employee directors’ equity compensation policy.an Amended and Restated 2016 Equity Incentive Plan. |

In addition, you are entitled to vote on any other matters that are properly brought before the Annual Meeting.

How domay I vote?

| · | | For Proposal No. 1, you may either vote “For” all the nominees to the Board, “Withhold” your vote from all of the nominees to the Board, or you may “Withhold” your vote for any nominee you specify. |

| · | | For Proposal No. 2, you may either vote “For” or “Against” or abstain from voting. |

| · | | For Proposal No. 3, you may either vote “For” or “Against” or abstain from voting. |

Please note that by casting your vote by proxy you are authorizing the individuals listed on the Proxy Card to vote your shares in accordance with your instructions and in their discretion with respect to any other matter that properly comes before the Annual Meeting or any adjournments or postponements thereof.

The procedures for voting are as follows:

Stockholder of Record: Shares Registered in Your Name

How many votes do I have?

If you are a stockholderholder of record,common stock, on each matter to be voted upon, you mayhave one vote in personfor each share of common stock you own as of the Record Date. If you are a holder of 5% convertible preferred stock, on each matter to be voted on, you have voting rights equal to approximately 130 votes for each share of 5% convertible preferred stock you own as of the Record Date (voting on an as-converted basis with the holders of common stock).

What vote is required to approve each matter and how will votes be counted?

The table below sets forth the vote required for each matter being submitted to our stockholders at the Annual Meeting. Alternatively, you may vote by proxy by using the accompanying Proxy Card, over the internet or by telephone. Whether or not you plan to attend the2021 Annual Meeting we encourage you to vote by proxybe approved and the effect that abstentions, withheld votes and broker non-votes will have on the outcome of voting on each proposal that is being submitted to ensure your vote is counted. Even if you have submitted a proxy beforeour stockholders for approval at the 2021 Annual Meeting, you may still attend the Annual Meeting and vote in person. In such case, your previously submitted proxy will be disregarded.Meeting.

| | | | | | |

| | | | | | |

Proposal | | Affirmative Vote Required | | Abstentions/ Withholds | | Broker Non-Votes |

Election of Directors

(Proposal No. 1) | | Plurality of votes cast by holders of common stock and 5% convertible preferred stock (voting on an as-converted basis with the holders of common stock) entitled to vote | | No effect(1) | | No effect |

Ratification of Selection of BDO USA LLP

(Proposal No. 2) |

| Majority of common stock and 5% convertible preferred stock (voting on an as-converted basis with the holders of common stock) present or represented and voting on the matter |

| No effect |

| Not applicable |

Approval of the Amended and Restated 2016 Equity Incentive Plan (Proposal No. 3) | | Majority of common stock and 5% convertible preferred stock (voting on an as-converted basis with the holders of common stock) present or represented and voting on the matter | | No effect | | No effect |

| ·(1)

| | ToYou may vote in person, come to“For” all of the Annual Meeting and we will give you a ballot when you arrive.director nominees, “Withhold” your vote from all of the director nominees or “Withhold” your vote from any of the director nominees.

|

| ·

| | To vote using the Proxy Card, simply complete, sign and date the accompanying Proxy Card and return it promptly in the envelope provided. If you return your signed Proxy Card to us before the Annual Meeting, we will vote your shares in accordance with the Proxy Card.

|

| ·

| | To vote by proxy over the internet, follow the instructions provided on the Notice of Internet Availability.

|

| ·

| | To vote by telephone, you may vote by proxy by calling the toll free number found on the Notice of Internet Availability.

|

Beneficial Owner: Shares Registered in the Name of Broker, Bank or Other Agent

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received a voting instruction card and voting instructions with these proxy materials from that organization rather than from us. Simply complete and mail the voting instruction card to ensure that your vote is counted. To vote in person at the Annual Meeting, you must obtain a valid proxy from your broker, bank or other agent. Follow the instructions from your broker, bank or other agent included with these proxy materials, or contact your broker, bank or other agent to request a proxy form.

We provide internet proxy voting to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your internet access, such as usage charges from internet access providers and telephone companies.

Who counts the votes?

Broadridge Financial Solutions, Inc. (“Broadridge”) has been engaged as our independent agent to tabulate stockholder votes, or Inspector of Election.votes. If you are a stockholder of record, your executed Proxy Card is returned directly to Broadridge for tabulation. As noted above, if you hold your shares through a broker, your broker returns one Proxy Card to Broadridge on behalf of all of its clients.

How areVotes tabulated by Broadridge, together with any votes counted?

Votescast at our 2021 Annual Meeting, will be counted by theour Inspector of ElectionElections appointed for the 2021 Annual Meeting, whoGregory S. Moss, our Executive Vice President, General Counsel and Corporate Secretary, Chief Compliance Officer. The Inspector of Elections will separately count “For” and, with respect to ProposalProposals No. 2 and ProposalNo. 3, “Against” votes, abstentions and broker non-votes. In addition, with respect to the election of directors, the Inspector of Election will count the number of “Withheld” votes received for the nominees. If your shares are held by your broker as your nominee (that is, in “street name”), you will need to obtain a proxy form from the institution that holds your shares and follow the instructions included on that form regarding how to instruct your broker to vote your shares. If you do not give instructions to your broker, your broker can vote your shares with respect to “routine” items, but not with respect to “non-routine” items. See below for more information regarding: “What“What are “broker non-votes?non-votes”?” and “Which“Which ballot measures are considered “routine” or “non-routine”?”

What are “broker non-votes”?

Broker non-votes occur when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed “non-routine.” Generally, if shares are held in street name, the beneficial owner of the shares is entitled to give voting instructions to the broker or nominee holding the shares. If the beneficial owner does not provide voting instructions, the broker or nominee can still vote the shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. In the event that a broker, bank, custodian, nominee or other record holder of common stock and 5% convertible preferred stock indicates on a proxy that it does not have discretionary authority to vote certain shares on a particular proposal, then those shares will be treated as broker non-votes with respect to that proposal. Accordingly, if you own shares through a nominee, such as a broker or bank, please be sure to instruct your nominee how to vote to ensure that your vote is counted on each of the proposals.

Which ballot measures are considered “routine” or “non-routine?”

The ratification of the appointment of BDO USA, LLP as our independent registered public accounting firm for the year ending December 31, 20172021 (Proposal No. 2) is considered routine under applicable rules. A broker or other nominee may generally vote on routine matters, and therefore no broker non-votes are expected to exist in connection with Proposal No. 2. The election of directors (Proposal No. 1) and the vote to approve our non-employee directors’ equity compensation policyapproval of the Amended and Restated 2016 Equity Incentive Plan (Proposal No. 3) are considered non-routine under applicable rules. A broker or other nominee cannot vote without instructions on non-routine matters, and therefore there may be broker non-votes on ProposalProposals No. 1 and Proposal 3.No. 3

How many votes are needed to approve the proposal?

With respect to Proposal 1, the election of directors, the nine nominees receiving the highest number of “For” votes will be elected.

With respect to Proposal 2, the affirmative vote of the majority of votes cast (excluding abstentions and broker non-votes) is required for approval. This is a routine proposal and therefore we do not expect any broker non-votes.

With respect to Proposal 3, the affirmative vote of the majority of votes cast (excluding abstentions and broker non-votes) is required for approval.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of the Record Date..

What if I return a Proxy Card but do not make specific choices?

If we receive a signed and dated Proxy Card and the Proxy Card does not specify how your shares are to be voted, your shares will be voted “For”in accordance with the election of each of the nine nominees for director, “For” the ratification of the appointment of BDO USA, LLP, as our independent registered public accounting firm and “For” the approvalrecommendations of our non-employee directors’ equity compensation policy. Board. If any other matter is properly presented at the Annual Meeting, your proxy (one of the individuals named on your Proxy Card) will vote your shares in his or her discretion.

Who is paying for this proxy solicitation?

We are soliciting this proxy on behalf of the Board and will pay for the entire cost of soliciting proxies. In addition to these mailed proxy materials, our directors, officers and employees may also solicit proxies in person, by telephone or by

other means of communication. Directors, officers and employees will not be paid any additional compensation for soliciting proxies. We will also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one set of materials?

If you receive more than one set of materials, your shares are registered in more than one name or are registered in different accounts. In order to vote all the shares you own, you must either sign and return all of the Proxy Cards or follow the instructions for any alternative voting procedure on each of the Proxy Cards.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the Annual Meeting. If you are the record holder of your shares, you may revoke your proxy in any one of three ways:

| · | | You may submit another properly completed proxy with a later date. |

| · | | You may send a written notice that you are revoking your proxy to the Secretary of the Board at Kadmon Holdings, Inc., 450 East 29th Street, New York, New York 10016. |

| · | | You may attend the Annual Meeting and vote in person. Simply attending the Annual Meeting will not, by itself, revoke your proxy. |

If your shares are held by your broker bank or other agent,brokerage firm, you should follow the instructions provided by them.

When are stockholder proposals due for next year’s Annual Meeting?

To be considered for inclusion in next year’s proxy materials, your proposal must be submitted in writing by January 10, 2018December 2, 2021 to the Secretary of the Board at Kadmon Holdings, Inc., 450 East 29th Street, New York, New York 10016; provided that if the date of the annual meeting is more than 30 days from June 28, 2018,May 12, 2022, the deadline is a reasonable time before we begin to print and send our proxy materials for next year’s annual meeting. Pursuant to theour bylaws, in order for a stockholder to present a proposal for next year’s annual meeting, other than proposals to be included in the proxy statement as described above, or to nominate a director, you must give timely notice thereof in writing to the Secretary of the Board, which must be received between March 1, 2018January 12, 2022 and March31, 2018;February 11, 2022; provided that if the date of that annual meeting is more than 30 days before or after June 28, 2018,May 12, 2022, notice must be received not later than the 90th day prior to the annual meeting date or the 10th day following the day on which public disclosure of the annual meeting date is first made. You are also advised to review our bylaws, which contain additional requirements about advance notice of stockholder proposals and director nominations.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if the holders of a majority in voting power of the shares of common stock and 5% convertible preferred stock issued and outstanding and entitled to vote are present in person or represented by proxy at the Annual Meeting. On the Record Date, there were 51,846,521171,816,945 shares of our common stock outstanding and entitled to vote.vote and 28,708 shares of 5% convertible preferred stock outstanding and entitled to vote (which, on an as-converted basis, represents voting rights equivalent to approximately 3,750,664 shares of common stock). Accordingly, 25,923,26187,783,806 shares must be represented by stockholders present at the Annual Meeting or by proxy to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy or vote at the Annual Meeting. Abstentions will be counted towards the quorum requirement. If there is no quorum, either the chair of the Annual Meeting or a majority in voting power of the stockholders entitled to vote at the Annual Meeting, present in person or represented by proxy, may adjourn the Annual Meeting to another time or place.

How can I find out the results of the voting at the Annual Meeting?

Voting results will be announced by the filing of a Current Report on Form 8-K within four business days after the Annual Meeting. If final voting results are unavailable at that time, we will file an amended Current Report on Form 8-K within four business days of the day the final results are available.

Implications of being an “emerging growth company.”

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 and, as such, have elected to comply with certain reduced public company reporting requirements. These reduced reporting

requirements include reduced disclosure about our executive compensation arrangements and no requirement to hold non-binding advisory votes on executive compensation. We will remain an emerging growth company until the earlier of (1) December 31, 2021, (2) the last day of the first fiscal year (a) following the fifth anniversary of the completion of our initial public offering, (b) in which we have totalour annual gross revenue of at leastrevenues exceed $1.07 billion, or (c) in(3) the date on which we are deemed to bebecome a large“large accelerated filer,filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, which meanswould occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the prior June 30, and (2)last business day of our most recently completed second fiscal quarter or (4) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-yearpreceding three year period.

Directions to Annual Meeting

Directions to our Annual Meeting, to be held at 450 East 29th Street, New York, New York 10016 are available at: www.kadmon.com.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Our Board is not divided into classes. Each director serves until his or her successor is elected. Except as otherwise provided by law, vacancies (including vacancies created by increases in the number of directors or by removal from office by a vote of the stockholders) on the Board may be filled only by a majority of the directors then in office. A director so chosen shall hold office for a term expiring at the next annual meeting of stockholders at which the term of office expires, and until his or her respective successor is elected, except in the case of the death, resignation or removal of any director. The Board currently consists of tenseven seated directors.directors and the Board will consist of seven seated directors following the 2021 Annual Meeting.

At each annual meeting of stockholders, the successors to directors whose terms will then expire will be elected to serve from the time of election and qualification until such director’s successor is elected and qualified.

Messrs. Schwartz, Boardman, Konidaris and Meehan,Kirsch, Drs. Waksal, Cohen and Bauer, Forbes and ShenkMses. Miller-Rich and Ms. WiviottSchwalm have been nominated to serve as directors and have each agreed to stand for reelection.reelection or election, as applicable. Each director to be elected will hold office from the date of his or her election by the stockholders until his or her successor is elected, or until such director’s earlier death, resignation or removal. The Board will consist of seven seated directors following the 2021 Annual Meeting.

Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the nineseven nominees named below. In the event that any nominee should be unavailable for election as a result of an unexpected occurrence, such shares will be voted for the election of such substitute nominee as the Board may propose. Each person nominated for election has agreed to serve if elected, and management has no reason to believe that any nominee will be unable to serve. Directors are elected by a plurality of the votes cast at the meeting.

The following table sets forth information for the nominees who are currently standing for reelection with respect to their ages as of March 15, 2021 and position/office held within the Company:

| | | | | |

Name | | Age | | Position | Director Since |

Directors | | | | | |

Harlan W. Waksal, M.D. | | 63 | | President, Chief Executive Officer and Director | 2013 |

Bart M. Schwartz, Esq. (3)(4) | | 70 | | Chairman of the Board | 2015 |

Eugene Bauer, M.D. (1)(2)(4) | | 74 | | Director | 2010 |

D. Dixon Boardman (1)(2)(3)(4) | | 71 | | Director | 2010 |

Alexandria Forbes, Ph.D. | | 52 | | Director | 2010 |

Tasos G. Konidaris (1) | | 50 | | Director | 2017 |

Steven Meehan (1) | | 52 | | Director | 2017 |

Thomas E. Shenk, Ph.D. (4) | | 70 | | Director | 2014 |

Susan Wiviott, J.D. (2)(3)(4) | | 59 | | Director | 2010 |

| | | | | |

Name | | Age | | Position | Director Since |

Directors | | | | | |

Harlan W. Waksal, M.D. (4) | | 67 | | President, Chief Executive Officer and Director | 2013 |

Tasos G. Konidaris (1)(2) | | 54 | | Chairman of the Board, Director | 2017 |

Eugene Bauer, M.D. (1)(2)(3)(4) | | 78 | | Director | 2010 |

Cynthia Schwalm (2)(3)(5) | | 61 | | Director | 2019 |

David E. Cohen, M.D. (2)(3)(4)(5) | | 56 | | Director | 2019 |

Nancy Miller-Rich (4)(5) | | 62 | | Director | 2020 |

Arthur Kirsch (1) | | 69 | | Director | 2019 |

(1) Member of the audit committeeAudit Committee

(2) Member of the compensation committeeCompensation Committee

(3) Member of the nominatingNominating and corporate governance committeeCorporate Governance Committee

(4) Member of the regulatoryScience and compliance committeeTechnology Committee

(5) Member of the Belumosudil Launch Oversight Committee

Set forth below is biographical information for the nominees and each person whose term of office as a director will continue after the Annual Meeting. The following includes certain information regarding our directors’ individual experience, qualifications, attributes and skills that led the Board to conclude that they should serve as directors.

Nominees for Election to a Term Expiring upon Such Director’s Successor Being Elected and Qualified

Harlan W. Waksal, M.D. Dr. Waksal has been our President and Chief Executive Officer since August 2014 and was elected to our Board in 2013. Prior to joining Kadmon as an employee, Dr. Waksal served as President and Sole Proprietor of Waksal Consulting LLC from 2003 to 2014. From 2011 to 2014, Dr. Waksal served as Executive Vice President, Business and Scientific Affairs at Acasti Pharma, Inc., a publicly traded biopharmaceutical company, and as a consultant to Neptune Technologies & Bioressources,Bioresources, Inc., a publicly traded life sciences company and the parent company of Acasti. Dr. Waksal co‑founded ImClone Systems (“ImClone”) in 1987, a publicly traded biopharmaceutical company acquired by Eli Lilly and Company in 2008. Dr. Waksal served in senior roles at ImClone, including: President (1987 to 1994); Executive Vice President and Chief Operating Officer (1994 to 2002); and President, Chief Executive Officer and Chief Operating Officer (2002 to 2003). Dr. Waksal also served as a Director of ImClone from 1987 to 2005. Dr. Waksal served on the boards of Oberlin College and Sevion Therapeutics through March 2016 and the boards of Acasti and Neptune through February 2016 and July 2015, respectively. Dr. Waksal received his B.A. from Oberlin College and his

M.D. from Tufts University School of Medicine. He completed his training in internal medicine at New England Medical Center and in pathology at Kings County Hospital Center in Brooklyn.

We believe Dr. Waksal’s extensive management experience in the life science industry and drug development experience provides him with the qualifications and skills to serve on our Board.

Bart M. Schwartz, Esq.Tasos G. Konidaris. Mr. SchwartzKonidaris has served as Chairmana member of our Board since 2015. Since 2010,February 2017 and was appointed chairman in 2019. Mr. SchwartzKonidaris has served as ChairmanSenior Vice President, Chief Financial Officer of Amneal Pharmaceuticals, Inc. since March 2020. He previously served as Executive Vice President and Chief ExecutiveFinancial Officer of SolutionPoint International,Alcresta Therapeutics, Inc. Prior to that, Mr. Konidaris served as Executive Vice President, Chief Financial Officer and Head of Corporate Development of Ikaria, Inc., the parenta biotherapeutics company, from 2011 to 2015. Prior to joining Ikaria, since 2007, Mr. Konidaris served as Senior Vice President and Chief Financial Officer at Dun & Bradstreet (D&B) Corporation, a leading commercial information services company, and previously held financial and general management roles of Guidepost Solutions, LLC, a global investigation, security consulting, complianceincreasing responsibility at Schering-Plough Corporation, Pharmacia Corporation, Novartis Corporation and monitoring firm where he also serves as Chairman.Bristol-Myers Squibb. Mr. SchwartzKonidaris currently serves on the board of HMS Holdings Corp., a publicly traded company where he is Chair of its Compliance CommitteeZep, Inc. Mr. Konidaris holds an MBA from Drexel University and a member of its Audit Committee. He also serves on the boards of the Police Athletic League and the Stuyvesant High School Alumni Association. Mr. Schwartz is Founder and former Chief Executive Officer of Decision Strategies, an investigative, compliance and security firm. In October 2015, Mr. Schwartz was appointed independent monitor by the U.S. Department of Justice to oversee General Motors’ compliance with its deferred prosecution agreement from its recall of defective ignition switches. Mr. Schwartz served under U.S. Attorney Rudolph Giuliani as the Chief of the Criminal Division in the Southern District of New York. Mr. Schwartz has had numerous additional court and other appointments to monitor the conduct of corporations and has received assignments from or with the approval of the SEC, the U.S. Commodity Futures Trading Commission, the U.S. Attorney’s Office for the Southern District of New York, the Manhattan District Attorney’s Office, the Attorney General of California, the Attorney General of New York, the New York Organized Crime Task Force, the New York City School Construction Authority and the New York State Department of Environmental Conservation. Mr. Schwartz received his B.S. from the University of Pittsburgh and his J.D. from New York University School of Law.Gwynedd Mercy College.

We believe Mr. Schwartz’s extensive legalKonidaris’ expertise and compliancefinancial experience provides him with the qualifications and skills to serve on our Board.

Eugene Bauer, M.D. Dr. Bauer has served as a member of our Board since 2010. In 2010, Dr. Bauer co‑founded Dermira, a publicly traded specialty biopharmaceutical company where he servesacquired by Eli Lilly and Company in 2020. Dr. Bauer served as Director and Chief Medical Officer.Officer of Dermira, a wholly owned subsidiary of Lilly, through March 2020. Prior to founding Dermira, Dr. Bauer served as Director, President and Chief Medical Officer of Pelpin, Inc., a publicly traded specialty pharmaceutical company, from 2008 to 2009. Dr. Bauer served as Chief Executive Officer of Neosil, Inc., a specialty pharmaceutical company, from 20062004 to 2008, and he co‑founded and served as a member of the board of directors at Connetics, a publicly traded specialty pharmaceutical company, from 1990 to 2006. Prior to initiating his career in industry, Dr. Bauer served as Dean of Stanford University School of Medicine from 1995 to 2001 and as Chair of the Department of Dermatology at Stanford University School of Medicine from 19951988 to 2001.1995. Dr. Bauer is the Lucy Becker Professor Emeritus at Stanford University School of Medicine, a position he has held since 2002. Dr. Bauer was a U.S. National Institutes of Health (“NIH”)‑funded investigator for 25 years and has served on review groups and Councils for the NIH. Dr. Bauer currently serves as a board member for Medgenics, Inc., Cerecor Inc. and First Wave Technologies. He is member of numerous honorific societies, including the National Academy of Medicine. Dr. Bauer received his B.S. from Northwestern University and his M.D. from Northwestern University Medical School.

We believe Dr. Bauer’s background of service on the boards of directors of numerous public pharmaceutical companies and his vast industry experience provides him with the qualifications and skills to serve on our Board.

D. Dixon Boardman.Cynthia Schwalm. Mr. BoardmanMs. Schwalm has served as a member of our Board since 2010. Mr. Boardman founded Optima Fund Management LLC, an alternative investment firm, in 1988 andJanuary 2019. Ms. Schwalm currently serves as its Chief Executive Officer. Mr. Boardman isthe Owner of EIR Advisory LLC, a healthcare-focused strategic partnership and investment company, and as a member of the President’s Councilboard of Memorial Sloan Kettering Cancer Center,directors at G1 Therapeutics, Caladrius Biosciences and Hikma Pharmaceuticals. From 2014 to October 2017, Ms. Schwalm served as President and Chief Executive Officer of Ipsen North America. Prior to joining Ipsen, Ms. Schwalm served in senior positions with various biotech and specialty pharmaceutical companies, including as President of Eisai Pharmaceuticals from 2008 to 2010, and at Amgen, Inc. as Vice President & General Manager of U.S. Oncology from 2005 to 2008 and Executive Director of the U.S. Oncology Business Unit from 2003 to 2005. Ms. Schwalm also previously held multiple commercial roles at Johnson & Johnson and Janssen Pharmaceutica, Inc. from 1985 to 2003. Ms. Schwalm has served as a member of the board of directors for privately held life science companies and non-profit organizations focused on health care delivery and global public policy. Ms. Schwalm received an Executive M.B.A. from Wharton School of Business and a B.S. in Nursing from the University of Delaware.

We believe Ms. Schwalm’s extensive management and leadership experience in the life science industry provides her with the qualifications and skills to serve on our Board.

David E. Cohen, M.D., M.P.H. Dr. Cohen has been a director of our company since February 2019. Dr. Cohen is the Charles C. and Dorothea E. Harris Professor of Dermatology at New York University School of Medicine, where he also serves as Chief of Allergy and Contact Dermatitis, Vice Chairman of Clinical Affairs, and Director of Occupational and Environmental Dermatology. Dr. Cohen joined the NYU faculty in 1994 and his work has concentrated on cutaneous allergic and toxic reactions to exogenous and photo-reactive chemicals and the interaction of environmental stressors on the skin. Dr. Cohen has previously served as a lecturer of Environmental Sciences at Columbia University School of Public Health since 1993 and has served as an Affiliated Faculty Member of the NYU Global Institute of Public Health since 2014. Dr. Cohen served on the board of directors of Dermira from 2014 until its acquisition by Eli Lilly and Company in 2020 and had previously served as a scientific advisor to Dermira since its inception in 2010. Dr. Cohen also served as Chairmanon the Boards of Vyteris from 2011 to 2012 and Connetics from 2005 until its acquisition by Stiefel in 2006. Dr. Cohen is the Past President of the Special Projects Committee.American Dermatological Association, and served as President of the American Contact Dermatitis Society, the Dermatology Section of the New York Academy of Medicine, and the New York Dermatological Association. Dr. Cohen served as a founding board member for the American Acne and Rosacea Society, and led the national guidelines of care for individuals with Latex allergy and served on the panel to establish the national guidelines of care for Atopic Dermatitis for the American Academy of Dermatology. Dr. Cohen received a B.S. in biomedical science from the City University of New York, an M.D. from State University of New York at Stony Brook School of Medicine and an M.P.H. in environmental science from Columbia University School of Public Health.

We believe that Dr. Cohen’s extensive experience in research and treatment, as well as his understanding of treatment from the physician’s perspective, qualify him to serve on our Board.

Nancy Miller-Rich. Ms. Miller-Rich has served as a member of our Board since August 2020. Ms. Miller-Rich has 35 years of experience in the pharmaceutical industry. Since September 2017, Ms. Miller-Rich has served as a consultant to several biopharmaceutical companies and healthcare organizations. Previously, Ms. Miller-Rich served as Senior Vice President, Global Human Health Business Development & Licensing, Strategy and Commercial Support at Merck from 2013 to 2017. At Merck, Ms. Miller-Rich’s responsibilities included direct global business development, alliance management, strategy and commercial assessment. Prior to this role, Ms. Miller-Rich was Group Vice President, Consumer Care Global New Ventures and Strategic Commercial Development at Schering-Plough from 2007 to 2013. Prior to joining Schering-Plough in 1990, Ms. Miller-Rich served in a variety of commercial and marketing roles at Sandoz (now Novartis) and at Sterling Drug. Ms. Miller-Rich currently serves as a member of the Board of Directors of Intercept Pharmaceuticals, Aldeyra Therapeutics and the TB Alliance as well as an advisor to 1063 Therapeutics and Aurora Bio. Ms. Miller-Rich received her B.S. in Business Administration and marketing from Ithaca College in Ithaca, New York.

We believe Ms. Miller-Rich’s extensive management and leadership experience in the life science industry provides her with the qualifications and skills to serve on our Board.

Arthur Kirsch. Mr. Kirsch has served as a member of our Board since 2019. Currently, Mr. Kirsch is a Senior Advisor with Alvarez and Marsal within the Life Sciences sector. He is also advises several private healthcare companies on strategic initiatives. Previously, he was a Senior Advisor and Head of Healthcare from 2005 to 2019 at GCA Global, an investment bank providing strategic M&A, capital markets and private funds advisory services to growth companies and market leaders. From 1994 to 2004, Mr. Kirsch was Global Head of Healthcare Research, with more than 200 companies under coverage, and later served as Head of Capital Markets at Vector Securities, a healthcare investment banking boutique that was later acquired by Prudential Securities. From 1990 to 1993, Mr. Kirsch was Chief Executive Officer of NatWest Markets, currently the investment banking arm of The Royal Bank of Scotland Group. Mr. Kirsch began his career on Wall Street at Drexel Burnham Lambert, where he served as Executive Vice President of the Global Equity Division, a member of the Executive Committee and notably was a #1-ranked Institutional Investor research analyst.

Mr. Kirsch serves on the Board of New York Presbyterian‑Weill Cornell Council.Directors of Liquidia Technologies, Inc., a public nanotechnology healthcare company, where he is also Chair of the Audit Committee. He previously served on the Board of Directors of Immunomedics, a public biopharmaceutical company, where he also served on the Audit Committee. Mr. BoardmanKirsch serves as Chairman of the Board of Directors at Aralez, Inc., a publicly traded biopharmaceutical company, where he is a Directoralso Chair of Florida Crystals Corporationthe Audit Committee. Mr. Kirsch received his B.A. in Finance from the University of Rhode Island and an Advisory Board Director of J.C. Bamford Excavators (UK)his MBA in Finance from Bernard M. Baruch College. Mr. Boardman attended McGill University.

We believe Mr. Boardman’s financialKirsch’s extensive finance and business expertiseleadership experience in the life science industry provides him with the qualifications and skills to serve on our Board.

Alexandria Forbes, Ph.D. Dr. Forbes has served as a member of our Board since 2010. Dr. Forbes has been President and Chief Executive Officer of MeiraGTx, an affiliate of Kadmon, since 2015. Prior to joining MeiraGTx, Dr. Forbes served as Senior Vice President of Strategic Operations and Chief Commercial Officer at Kadmon from 2013 to 2015. Dr. Forbes spent 13 years as a healthcare investor at hedge funds Sivik/Argus Partners and Meadowvale Asset Management. Prior to entering the hedge fund industry, Dr. Forbes was a Human Frontiers/Howard Hughes postdoctoral fellow at the Skirball Institute of Biomolecular Medicine at NYU Langone Medical Center. Prior to this, Dr. Forbes was a research fellow at Duke University and also at Carnegie Institute at Johns Hopkins University. Dr. Forbes received her M.A. from Cambridge University and her Ph.D. from Oxford University.

We believe Dr. Forbes’ business and financial expertise as well as her scientific background provide her with the qualifications and skills to serve on our Board.

Tasos G. Konidaris. Mr. Konidaris was appointed to our Board in February 2017. Mr. Konidaris has served as Executive Vice President and Chief Financial Officer of Alcresta Pharmaceuticals, LLC since March 2016. Prior to that, he was Senior Vice President and Chief Financial Officer of Ikaria, Inc., a biotherapeutics company, from October 2011 to May 2015. Prior to joining Ikaria, since 2007, Mr. Konidaris served as Senior Vice President and Chief Financial Officer at Dun & Bradstreet (“D&B”) Corporation, a leading commercial information services company. He was Principal Accounting Officer and led the Global Finance Operations of D&B beginning in 2005. From 2003 to 2005, Mr. Konidaris served as Group Vice President of the Global Pharmaceutical and Global Diversified Products Groups at Schering-Plough Corporation, a pharmaceutical company. Earlier in his career, Mr. Konidaris held senior financial and operational positions of increasing responsibility at the Pharmacia Corporation, Rhone-Poulenc Rorer, Novartis Corporation and Bristol-Myers Squibb Company. Mr. Konidaris was a director of Delcath Systems Inc. from July 2012 until December 2014. Mr. Konidaris holds an MBA from Drexel University, and a BS from Gwynedd Mercy College.

We believe Mr. Konidaris’ expertise and financial experience provides him with the qualifications and skills to serve on our board of directors.

Steven Meehan. Mr. Meehan was appointed to our Board in 2017. Mr. Meehan brings to the Board over 25 years of investment banking experience. Mr. Meehan was a Partner in the Healthcare Group of Moelis & Company from 2011 through 2016, leading the effort in Life Sciences and Advanced Diagnostics. Additionally, Mr. Meehan was previously the Head of Life Sciences within the Global Healthcare Group in the New York office of UBS Investment Bank (“UBS”). Mr. Meehan was also part of the team that formed the Healthcare Group at UBS in 1999. During Mr. Meehan’s tenure at UBS, he was Chief Executive Officer of UBS Russia and CIS across all businesses including securities, banking and wealth management. Mr. Meehan was also a member of the UBS Group EMEA Management Committee. During his investment banking career, Mr. Meehan also held senior roles in M&A, leveraged finance and capital markets at Salomon Smith Barney, NatWest Securities and Drexel Burnham Lambert.

We believe Mr. Meehan’s expertise and financial experience provides him with the qualifications and skills to serve on our Board.

Thomas E. Shenk, Ph.D. Dr. Shenk has served as a member of our Board since 2014 and he has served as a member of Kadmon’s Scientific Advisory Board since December 2013. Dr. Shenk has been the James A. Elkins Jr. Professor of Life Sciences in the Department of Molecular Biology at Princeton University since 1984. Dr. Shenk is a fellow of the American Academy of Arts and Sciences and a member of the U.S. National Academy of Sciences and the National Academy of Medicine. Dr. Shenk serves as the Chairman of the Board of MeiraGTx, an affiliate of Kadmon. He is a past president of the American Society for Virology and the American Society for Microbiology and served on the board of Merck and Company from 2001 to 2012. Dr. Shenk currently serves as a board member of the Hepatitis B Foundation. Dr. Shenk received his B.S. from the University of Detroit and his Ph.D. from Rutgers University.

We believe Dr. Shenk’s expertise and experience serving as a director in the pharmaceutical sector and his academic background provides him with the qualifications and skills to serve on our Board.

Susan Wiviott, J.D. Ms. Wiviott has served as a member of our Board since 2010. Ms. Wiviott has served as the Chief Executive Officer of The Bridge, a non‑profit behavioral health treatment and housing agency in New York, since 2014. Prior to joining The Bridge, Ms. Wiviott served as Chief Program Officer at Palladia Inc., a not‑for‑profit housing and substance abuse treatment provider, from 2012 through 2014. From 1999 through 2012, Ms. Wiviott served as Deputy Executive Vice President of the Jewish Board of Family and Children’s Services. Ms. Wiviott began her career as an associate at Sidley Austin LLP. Ms. Wiviott received her B.A. from the University of Wisconsin and her J.D. from Harvard Law School.

We believe Ms. Wiviott’s executive and legal experience provides her with the qualifications and skills to serve on our Board.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE

FOR THE ELECTION OF EACH OF THE ABOVE NAMED NOMINEESDIRECTOR NOMINEES.

PROPOSAL NO. 2

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of our Board has engaged BDO USA, LLP (“BDO”), as our independent registered public accounting firm for the year ending December 31, 2017,2021, and is seeking ratification of such selection by our stockholders at the Annual Meeting. BDO has audited our financial statements for each of our fiscal years since the fiscal year ended December 31, 2010. Representatives of BDO are expected to be present at the Annual Meeting. They will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Neither our bylaws nor other governing documents or applicable law require stockholder ratification of the selection of BDO as our independent registered public accounting firm. However, the Audit Committee is submitting the selection of BDO to our stockholders for ratification as a matter of good corporate practice. If our stockholders fail to ratify the selection, the Audit Committee will reconsider whether or not to retain BDO. Even if the selection is ratified, the Audit Committee, in its discretion, may direct the appointment of a different independent registered public accounting firm at any time during the year if they determine that such a change would be in the best interests of the Company and our stockholders.

Principal Accountant Fees and ServicesServices

The following table provides information regarding the fees incurred to BDO during the years ended December 31, 20162020 and 2015.2019. The Audit Committee approved all of the fees described below.

| | | | | | | | |

| | | | | | | | |

| | Year Ended December 31, | | Year Ended December 31, |

| | 2016 | | 2015 | | 2020 | | 2019 |

| | (In thousands) | | (In thousands) |

Audit Fees(1) | | $ | 1,062 | | $ | 679 | | $ | 661 | | $ | 829 |

Tax Fees | | 93 | | 84 | | — | | — |

Audit-Related Fees | | — | | — | | — | | — |

All Other Fees | | | — | | | — | | | — | | | — |

Total Fees | | $ | 1,155 | | $ | 763 | | $ | 661 | | $ | 829 |

| (1) | | Audit fees of BDO USA, LLP for the years ended December 31, 20162020 and 20152019 were for professional services rendered for the audits of our financial statements, including accounting consultation and reviews of quarterly financial statements. Fees for 2016statements, as well as services rendered in connection with preparing and 2015 include $0.4 million and $0.2 million, respectively, for services associatedreviewing registration statements in connection with our initial public offering (the “IPO”), which was completed in August 2016.securities offerings. |

Pre-Approval Policies and Procedures

The Audit Committee or a delegate of the Audit Committee, to the extent permitted by applicable laws, pre-approves, or provides pursuant to pre-approvalspre-approval policies and procedures for the pre-approval of, all audit and non-audit services provided by its independent registered public accounting firm. This policy is set forth in the charter of the Audit Committee and is available at www.kadmon.com.

The Audit Committee approved all of the estimated costs of the audit audit-related, tax and other services provided by BDO since our initial public offering in August 20162020 and the estimated costs of those services.2019. Actual amounts billed, to the extent in excess of the estimated amounts, are periodically reviewed and approved by the Audit Committee.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR RATIFICATION OF OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM.

PROPOSAL NO. 3REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

VOTE TO APPROVE OUR NON-EMPLOYEE DIRECTORS’ EQUITY COMPENSATION POLICYThe material in this report is not “soliciting material,” is not deemed “filed” with the SEC, and is not to be incorporated by reference into any filing of Kadmon under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended.

Our Board recommends that stockholders vote FOR this proposalThe primary purpose of the Audit Committee is to approveoversee our Non-Employee Directors’ Equity Compensation Policy (the “NED Compensation Policy”). The NED Compensation Policy was initially adopted by our Boardfinancial reporting processes on November 20, 2015, authorizing up to 60,000 options to purchase shares of our common stock to the chairmanbehalf of our Board of Directors. The Audit Committee’s functions are more fully described in its charter, which is available on our website at www.kadmon.com. Management has the primary responsibility for our financial statements and chairmanreporting processes, including our systems of ourinternal controls. In fulfilling its oversight responsibilities, the Audit Committee reviewed and discussed with management Kadmon’s audited financial statements as of and for the year ended December 31, 2020.

The Audit Committee has discussed with BDO USA, LLP (“BDO”), the Company’s independent registered public accounting firm, the matters required to be discussed by Auditing Standard No. 1301, “Communications with Audit Committees,” as adopted by the Public Company Accounting Oversight Board (the “PCAOB”). In addition, the Audit Committee discussed with BDO their independence, and received from BDO the written disclosures and the letter required by Ethics and Independence Rule 3526 of the PCAOB. Finally, the Audit Committee discussed with BDO, with and without management present, the scope and results of BDO’s audit committeeof such financial statements.

Based on these reviews and 20,000 optionsdiscussions, the Audit Committee has recommended to purchase shares of our common stock to all other non-employee Directors (which was adjusted to 9,231 and 3,077 options to purchase shares of our common stock, respectively, in connection with the one-for-six and one half reverse stock split on July 26, 2016) under the 2011 Equity Incentive Plan.

On December 5, 2016, our Board adopted changes to the NED Compensation Policy to increase the annual number of options to purchase shares ofDirectors that such audited financial statements be included in our common stock to 50,000 for the chairman of our Board and the chairman of our audit committee and 25,000 for all other non-employee Directors (the “Annual Options).

This change becomes effective this June for the Annual Options to be granted to Directors at the time of our Annual General Meeting on June 29, 2017. These Annual Options will be subject to one year of service vesting. These changes were made, taking into account a report on board compensation prepared by Veritas Executive Compensation Consultants. The Annual Options are being granted under our 2016 Equity Incentive Plan (the “2016 Plan”), which includes an annual limit on non-employee Director equity compensation equal to $300,000 divided by the fair market value of shares of our common stock underlying awards.

The number of shares underlying the Annual Options is within this annual dollar-denominated limit under the 2016 Plan, based on our current stock price. However, if our stock price increases to $6 per share or above, the chairman of our Board and the chairman of our audit committee’s Annual Option grant would need to be decreased.

On April 4, 2017 the Board approved as part of the NED Compensation Policy a clarifying modification to the annual limit for director grants to be $300,000 divided by the fair value of an award on the grant date rather than the fair market value of shares of our common stock underlying the award on the grant date. This is so the annual limits on awards will be based on the dollar value or accounting expense of those awards, regardless of whether the award is granted as restricted shares, restricted stock units or options. The Company has elected to grant equity to non-employee Directors in the form of options to purchase shares of our common stock, which only have value if the price of a share of our common stock increases over the grant date price and, for those reasons, options typically also have a lower fair value than restricted shares or restricted stock units. If you approve this proposal, non-employee Directors will be eligible to receive grants not to exceed $300,000 divided by the fair value of each equity award on its grant date, and the Annual Options will be subject to this limit.

We are not seeking any changes to the material terms of the 2016 Plan, or any increase in the number of shares of our common stock under the 2016 Plan available to Directors or employees (or any changes to the terms of the plan applicable to employees) or that would be a material modification of the 2016 Plan under the meaning of Section 162(m) of the Code or that trigger shareholder approval requirements under the NYSE listing rules. We are seeking your approval as a matter of transparency with our shareholders and good corporate governance.

The shares underlying the Annual Options would be drawn from remaining shares under the 2016 Plan. As of January 1, 2017, 2,085,631 shares were available for issuance under the 2016 Plan.

For more information about the NED Compensation Policy and the 2016 Plan, see the “Director Compensation” and “Information About Stock Ownership” sections of this Proxy Statement and the 2016 Plan, which is filed as Exhibit 10.10 to the Company’s Annual Report on Form 10-K for the year ended December 31, 2016 filed on March 22, 2017.

If you do not approve this proposal, we will continue to grant the Annual Options subject to the limitations of the 2016 Plan as drafted. This would result in the unintended result that our non-employee Directors’ compensation would decrease as a result of the Company generating strong stock price performance2020 for investors.

Our Board believes that the ability to grant equity to our non-employee Directors is critical to our efforts to attract and retain key talent on our Board and to encourage ownership of shares of our common stock by our non-employee Directors. Only non-employee Directors may participate in the NED Compensation Policy. The Company grants its non-employee Directors option awards, instead of restricted stock awards, to closely align the interests of our non-employee Directorsfiling with the interestsSEC. The Audit Committee also has engaged BDO as our independent registered public accounting firm for the fiscal year ending December 31, 2021 and is seeking ratification of our shareholders.such selection by the stockholders.

Audit Committee

Tasos G. Konidaris, Chair

Arthur Kirsch

Eugene Bauer, M.D.

PROPOSAL NO. 3

AMENDMENT AND RESTATEMENT TO THE 2016 EQUITY INCENTIVE PLAN

General

On March 18, 2021, our Board approved an Amendment and Restatement to the 2016 Equity Incentive Plan, (the “2016 Equity Plan”), to remove the current non-employee director award limit set forth in the 2016 Equity Plan, subject to stockholder approval. We are requesting that stockholders approve the removal of the current non-employee director award limit set forth in Section 5.04 of the 2016 Equity Plan.

If this proposal is approved, we will be able to grant equity awards to our non-employee directors under the 2016 Equity Plan with a fair value greater than the current $300,000 limit for the 2021 fiscal year and thereafter. If this proposal is not approved by stockholders, we will be unable to grant any equity awards to our non-employee directors under the 2016 Equity Plan in excess of $300,000, which will require us to limit amounts that would have otherwise been payable under our director compensation program.

Reasons for the Proposal

Based on our review of market data from the Compensation Committee’s independent compensation consultant, Veritas, we believe that the proposed removal of the non-employee director award limit is reasonable and in line with compensation practices at our peer companies. As previously disclosed, the Compensation Committee, along with Veritas, annually prepares a comprehensive assessment of our non-employee director compensation program. The annual assessment includes benchmarking of director compensation against the same peer group used for executive compensation purposes, an update on recent trends in director compensation, and a review of related corporate governance best practices. We believe the proposed removal in the non-employee director award limit is necessary in order to potentially implement changes to our director compensation program in the future in order to align our director compensation program with our peers’ programs.

Description of the Proposed Amendment and Other 2016 Equity Plan Terms

The following is a summary of the material terms of the 2016 Equity Plan, as amended and restated. Such description is qualified by reference to the full text of the 2016 Equity Plan, which is appended hereto as Appendix A. Changes to the 2016 Equity Plan in the amendment and restatement are marked in Appendix A.

Text of Proposed Amendment

If approved by stockholders, Section 5.4 of the 2016 Equity Plan, as copied below, would be removed in its entirety.

Current 2016 Equity Plan:

No Nonemployee Director shall be granted within any fiscal year of the Company one or more Nonemployee Director Awards pursuant to the Plan which in the aggregate are for more than a number of shares of Stock determined by dividing three hundred thousand dollars U.S. ($300,000) by the fair value of the Nonemployee Director Award determined on the day the applicable Nonemployee Director Award is granted.

Amended and Restated 2016 Equity Plan:

No Nonemployee Director shall be granted within any fiscal year of the Company one or more Nonemployee Director Awards pursuant to the Plan which in the aggregate are for more than a number of shares of Stock determined by dividing [XXX] thousand dollars U.S. ($XXX) by the fair value of the Nonemployee Director Award determined on the day the applicable Nonemployee Director Award is granted.

No other changes to the 2016 Equity Plan are being proposed at this time.

Summary of the 2016 Equity Plan

2016 Equity Plan Purpose

Our 2016 Equity Plan is intended to make available incentives that will assist us to attract, retain and motivate employees, including officers, consultants and directors. We may provide these incentives through the grant of stock options, stock appreciation rights, restricted stock, restricted stock units, performance shares and units and other cash-based or stock-based awards.

Administration

The 2016 Equity Plan is administered by the Compensation Committee. Subject to the provisions of the 2016 Equity Plan, the Compensation Committee determines in its discretion the persons to whom and the times at which awards are granted, the sizes of such awards and all of their terms and conditions. However, the Compensation Committee may delegate to one or more of our officers the authority to grant awards to persons who are not officers or directors, subject to certain limitations contained in the 2016 Equity Plan and award guidelines established by the Compensation Committee. The Compensation Committee has the authority to construe and interpret the terms of the 2016 Equity Plan and awards granted under it. The 2016 Equity Plan provides, subject to certain limitations, for indemnification by us of any director, officer or employee against all reasonable expenses, including attorneys' fees, incurred in connection with any legal action arising from such person's action or failure to act in administering the 2016 Equity Plan.

Available Shares

At the time we established the 2016 Equity Plan, we reserved 6,720,000 shares of our common stock for issuance under the 2016 Equity Plan. As of March 5, 2021, there were 28,646,939 shares of our common stock authorized and reserved for issuance under the 2016 Equity Plan, with 10,835,197 shares available for future grants. Appropriate adjustments will be made in the number of authorized shares and other numerical limits in the 2016 Equity Plan and in outstanding awards to prevent dilution or enlargement of participants' rights in the event of a stock split or other change in our capital structure. Shares subject to awards which expire or are cancelled or forfeited will again become available for issuance under the 2016 Equity Plan. The shares available will not be reduced by awards settled in cash or by shares withheld to satisfy tax withholding obligations. Only the net number of shares issued upon the exercise of stock appreciation rights or options exercised by means of a net exercise or by tender of previously owned shares will be deducted from the shares available under the 2016 Equity Plan.

Eligibility for Participation

Awards may be granted under the NED Compensation Policy. Generally, no taxable income is recognized2016 Equity Plan to our employees, including officers, directors or consultants or those of any present or future parent or subsidiary corporation or other affiliated entity. All awards will be evidenced by a non-employee Director uponwritten agreement between us and the holder of the award.

Awards

The 2016 Equity Plan provides for the grant of nonqualified and incentive stock options, stock appreciation rights, restricted stock awards, restricted stock units, and other performance shares or performance units that may be settled in, or based upon the value of, our common stock.

Stock options

We may grant nonstatutory stock options or incentive stock options (as described in Section 422 of the Internal Revenue Code), each of which gives its holder the right, during a nonstatutory option, nor will wespecified term (not exceeding 10 years) and subject to any specified vesting or other conditions, to purchase a number of shares of our common stock at an exercise price per share determined by the administrator, which may not be entitledless than the fair market value of a share of our common stock on the date of grant.

Stock appreciation rights

A stock appreciation right gives its holder the right, during a specified term (not exceeding 10 years) and subject to a deduction at that time. A non-employee Director will generally recognize ordinary incomeany specified vesting or other conditions, to receive the appreciation in the yearfair market value of our common stock between the date of grant of the award and the date of its exercise. We may pay the appreciation in shares of our common stock or in cash.

Restricted stock

The Compensation Committee may grant restricted stock awards either as a bonus or as a purchase right at such price as the Compensation Committee determines. Shares of restricted stock remain subject to forfeiture until vested, based on such terms and conditions as the administrator specifies. Holders of restricted stock will have the right to vote the shares and to receive any dividends paid, except that the dividends may be subject to the same vesting conditions as the related shares.

Restricted stock units

Restricted stock units represent rights to receive shares of our common stock (or their value in cash) at a future date without payment of a purchase price, subject to vesting or other conditions specified by the administrator. Holders of restricted stock units have no voting rights or rights to receive cash dividends unless and until shares of common stock are issued in settlement of such awards. However, the Compensation Committee may grant restricted stock units that entitle their holders to dividend equivalent rights.

Performance shares and performance units

Performance shares and performance units are awards that will result in a payment to their holder only if specified performance goals are achieved during a specified performance period. Performance share awards are rights whose value is based on the fair market value of shares of our common stock, while performance unit awards are rights denominated in dollars. The Compensation Committee establishes the applicable performance goals based on one or more measures of business performance enumerated in the 2016 Equity Plan, such as revenue, gross margin, net income or total stockholder return. To the extent earned, performance share and unit awards may be settled in cash or in shares of our common stock. Holders of performance shares or performance units have no voting rights or rights to receive cash dividends unless and until shares of common stock are issued in settlement of such awards. However, the Compensation Committee may grant performance shares that entitle their holders to dividend equivalent rights.